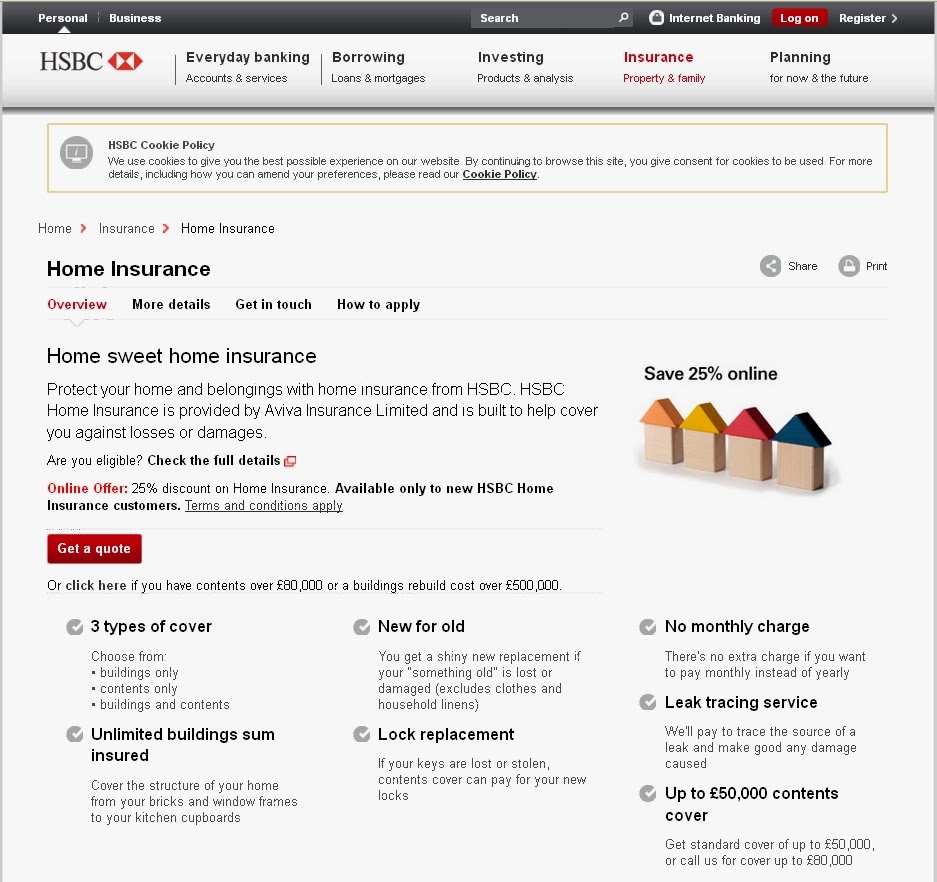

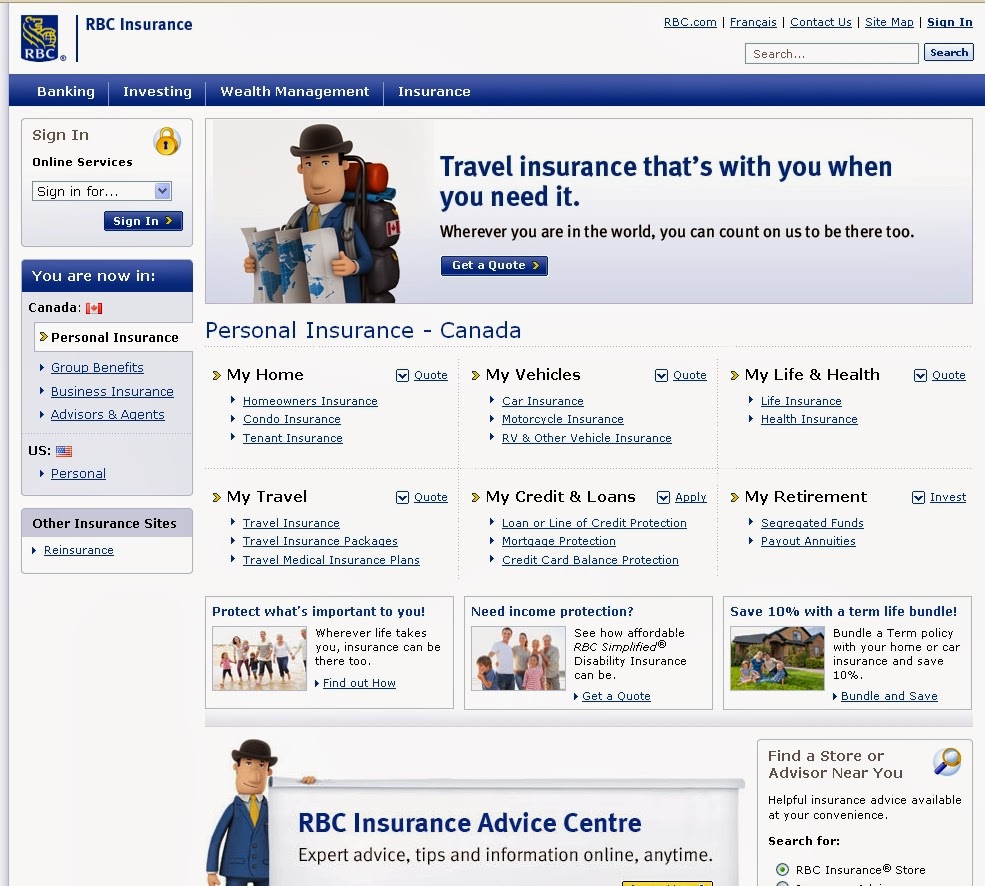

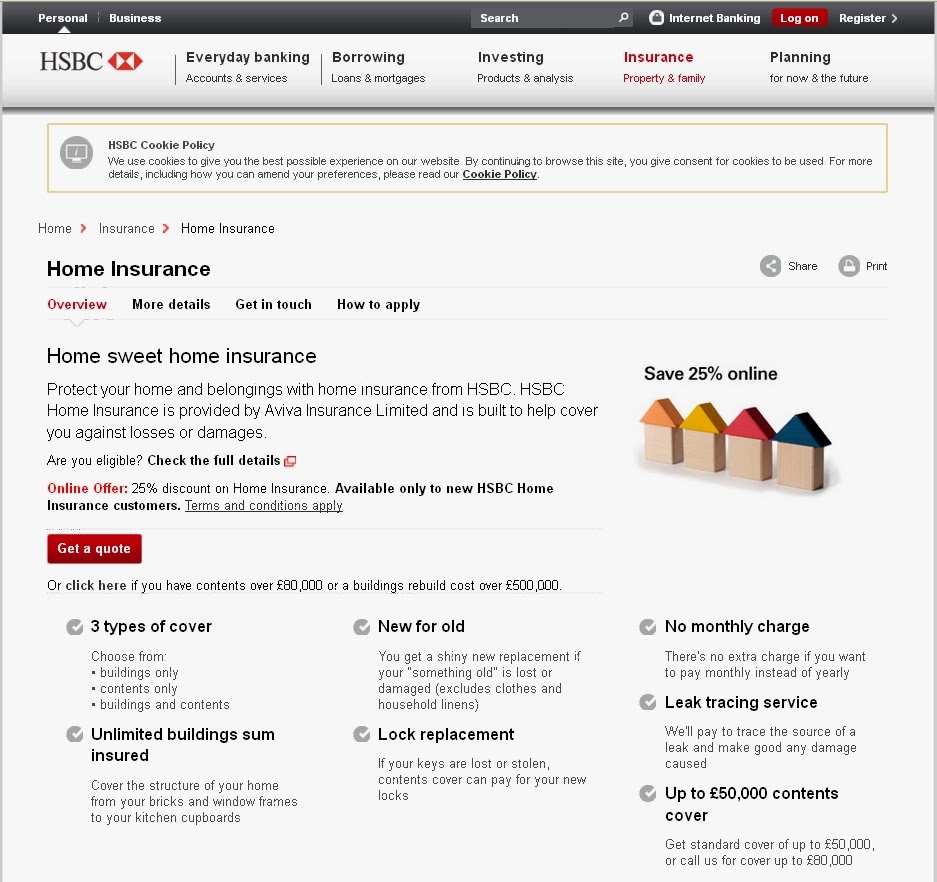

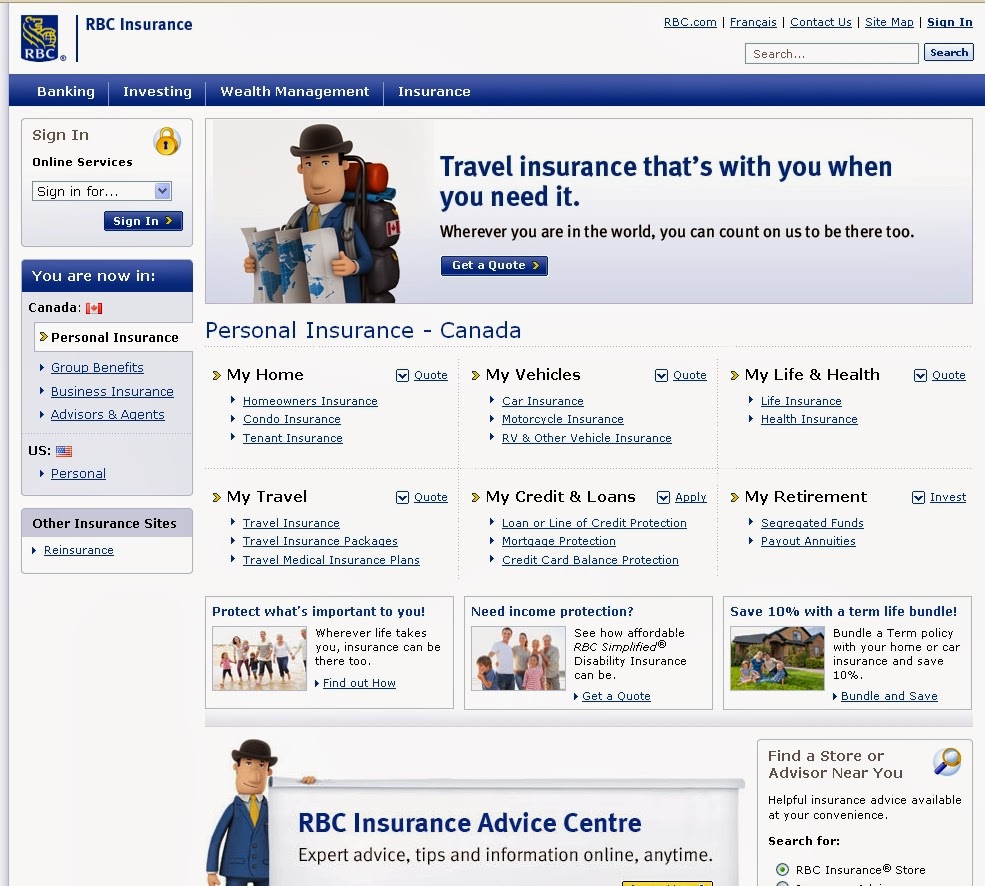

Your home is not safe if left uninsured . Many things can happen that can replace you from your home . Such as natural disasters , fires and buglers . All that can happen at any time and you will lose if you do not get compensation because your home is not insured properly .

Read more